Vertical Solutions Forecast

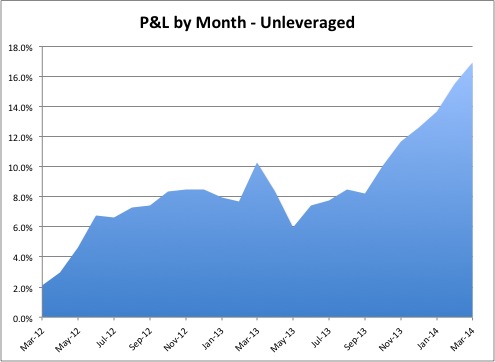

P&L’s for March and Since Inception

Quick Summary

+1.4% March

Current rate of return: +17.5% un-leveraged

Profitable 6 of last 6 months, profitable 9 of last 10 months

Drawdowns continue to be minimal

In October 2013, we developed an algorithm called Edge which has improved our results

Vertical Solutions Forecast, March 2012 – March 2014, Total Return

Vertical Solutions Forecast w/ Edge, October 2013 – March 2014

| Gross | 8.7% |

| Avg/mo. | 1.5% |

| Avg/yr | 17.5% |

| % Profitable | 100% |

| Std Dev/mo | 0.4% |

| z | 8.82 |

| Sharpe | 3.6 |

Vertical Solutions Forecast, March 2012 – March 2014

| Gross | 16.9% |

| Avg/mo. | 0.7% |

| Avg/yr | 8.1% |

| % Profitable | 76% |

| Std Dev/mo | 1.2% |

| z | 2.80 |

| Sharpe | 0.6 |

Monthly Returns, March 2012 – March 2014

| Date | %/Contract |

| Mar-12 | 2.1% |

| Apr-12 | 0.9% |

| May-12 | 1.7% |

| Jun-12 | 2.1% |

| Jul-12 | -0.1% |

| Aug-12 | 0.6% |

| Sep-12 | 0.2% |

| Oct-12 | 0.9% |

| Nov-12 | 0.1% |

| Dec-12 | 0.0% |

| Jan-13 | -0.5% |

| Feb-13 | -0.3% |

| Mar-13 | 2.6% |

| Apr-13 | -1.9% |

| May-13 | -2.4% |

| Jun-13 | 1.5% |

| Jul-13 | 0.3% |

| Aug-13 | 0.7% |

| Sep-13 | -0.3% |

| Oct-13 | 1.9% |

| Nov-13 | 1.6% |

| Dec-13 | 0.9% |

| Jan-14 | 1.0% |

| Feb-14 | 1.9% |

| Mar-14 | 1.4% |

Notes:

We continue to focus on using and understanding Edge

We are working on extending the time frame of trades

Results are live trades, not a simulation

*A Sharpe Ratio on 6 months results is still a bit silly

—h

Henry Carstens

503-701-5741

carstens@verticalsolutions.com

www.verticalsolutions.com