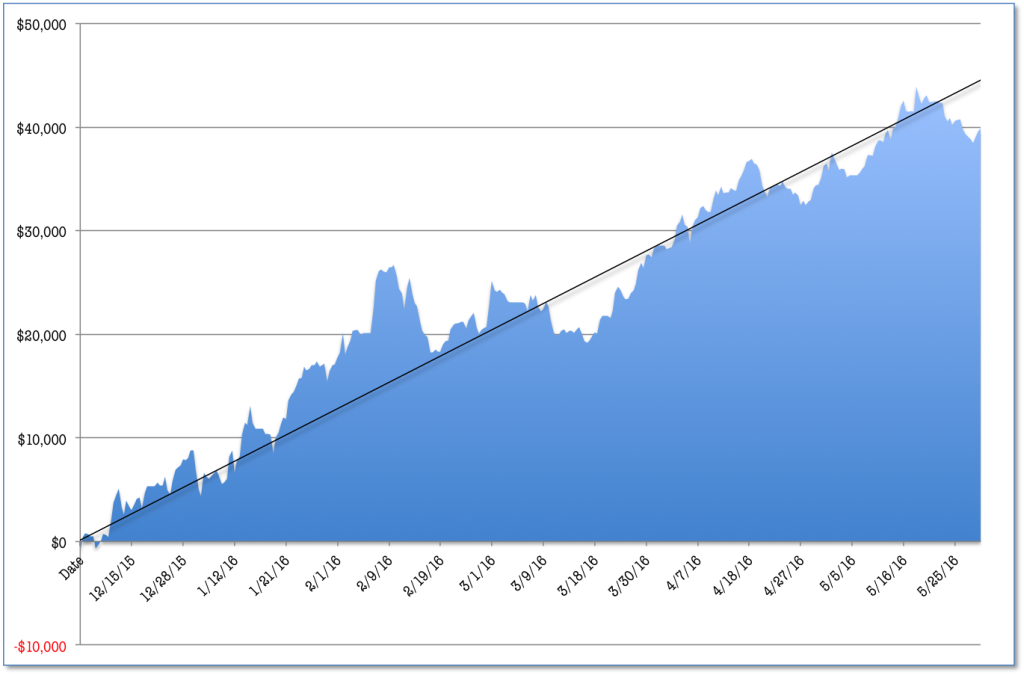

Forecast Quicklook Performance:

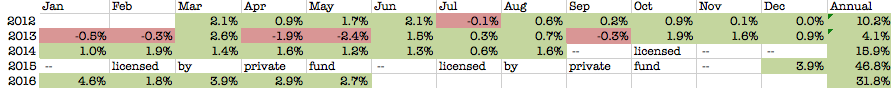

Forecast Monthly Performance (on $200,000):

|

Month |

Return % |

Return/Contract |

|

|

Dec |

3.9% |

$7,835 |

|

|

Jan |

4.6% |

$9,197 |

|

|

Feb |

1.8% |

$3,691 |

|

|

March |

3.9% |

$7,862 |

|

|

April |

2.9% |

$5,825 |

|

|

May |

2.7% |

$5,481 |

|

Forecast Statistics:

Win/Loss Ratio: 60%

Annualized Return: 34%

Max DD: 4.3%

Alpha v SP500: 34%

Alpha v CTA: 33%

Forecast Notes:

In February, the last time the Forecast had a drawdown similar to the drawdown of the last half of May, it signaled a regime change.

Current results, December 2015 to present, represent the third refinement of the forecasting techniques underlying the Trend Day Forecast since 2012. The second refinement was the development of a quantitative technique known as Edge in October of 2013.

Licensing:

The Trend Day Forecast is available by subscription. The underlying strategy is available for license. Contact Henry Carstens, 503-701-5741.

Other notes:

My book, 101 Trading Ideas for Fast-Paced Alpha Hunting will be published next week! The book helps users quickly create new trading ideas. Additionally, I’m really becoming quite obsessed with the idea that historical backtesting, with 90% of strategies underperforming when they move to out-of-sample, is ripe for change.

—h

Henry Carstens

503-701-5741

carstens@verticalsolutions.com

www.verticalsolutions.com