Forecast, Quick P&L’s, February and To-Date

Quick Summary

Annual rate of return: +17.6% (un-leveraged)

In October 2013, we developed an algorithm called Edge which helps us quantify the opportunity in a trade

Since the development of Edge, the rate of return of the Forecast has risen to +17.6% per year and our trade-by-trade standard dev has dropped by 72%

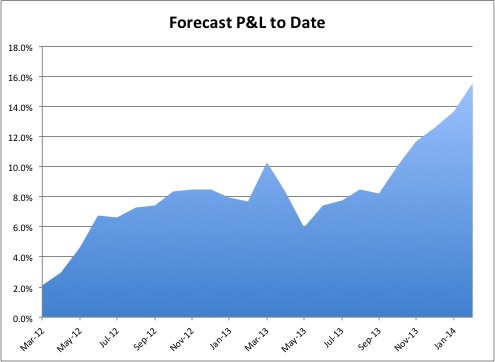

Forecast P&L, 2012-p

Edge P&L, Monthly, October 2013-Feb 2014

|

Gross |

7.3% |

|

|

|

|

Avg/mo. |

1.5% |

|

|

|

|

Avg/yr |

17.6% |

|

|

|

|

% Profitable |

100% |

|

|

|

|

Std Dev/mo |

0.5% |

|

|

|

|

z |

7.26 |

|

|

|

|

Sharpe* |

3.2 |

Forecast P&L, Monthly, March 2012 – Feb 2014

|

Gross |

15.5% |

|

|

|

|

Avg/mo. |

0.6% |

|

|

|

|

Avg/yr |

7.8% |

|

|

|

|

% Profitable |

75% |

|

|

|

|

Std Dev/mo |

1.2% |

|

|

|

|

z |

2.58 |

|

|

|

|

Sharpe |

0.5 |

Monthly Returns, 2012-p

|

Date |

%/unit |

|

Mar-12 |

2.1% |

|

Apr-12 |

0.9% |

|

May-12 |

1.7% |

|

Jun-12 |

2.1% |

|

Jul-12 |

-0.1% |

|

Aug-12 |

0.6% |

|

Sep-12 |

0.2% |

|

Oct-12 |

0.9% |

|

Nov-12 |

0.1% |

|

Dec-12 |

0.0% |

|

Jan-13 |

-0.5% |

|

Feb-13 |

-0.3% |

|

Mar-13 |

2.6% |

|

Apr-13 |

-1.9% |

|

May-13 |

-2.4% |

|

Jun-13 |

1.5% |

|

Jul-13 |

0.3% |

|

Aug-13 |

0.7% |

|

Sep-13 |

-0.3% |

|

Oct-13 |

1.9% |

|

Nov-13 |

1.6% |

|

Dec-13 |

0.9% |

|

Jan-14 |

1.0% |

|

Feb-14 |

1.9% |

Notes:

We continue to focus on using Edge to identify trades and understanding when Edge gets overwhelmed by real world events

That should lead to more and better opportunities and continued low standard deviation

*A Sharpe Ratio on 5 months results is still a bit silly

—h

Henry Carstens

503-701-5741

carstens@verticalsolutions.com

www.verticalsolutions.com