Dependency Tests for Trading Systems, 01/25/08

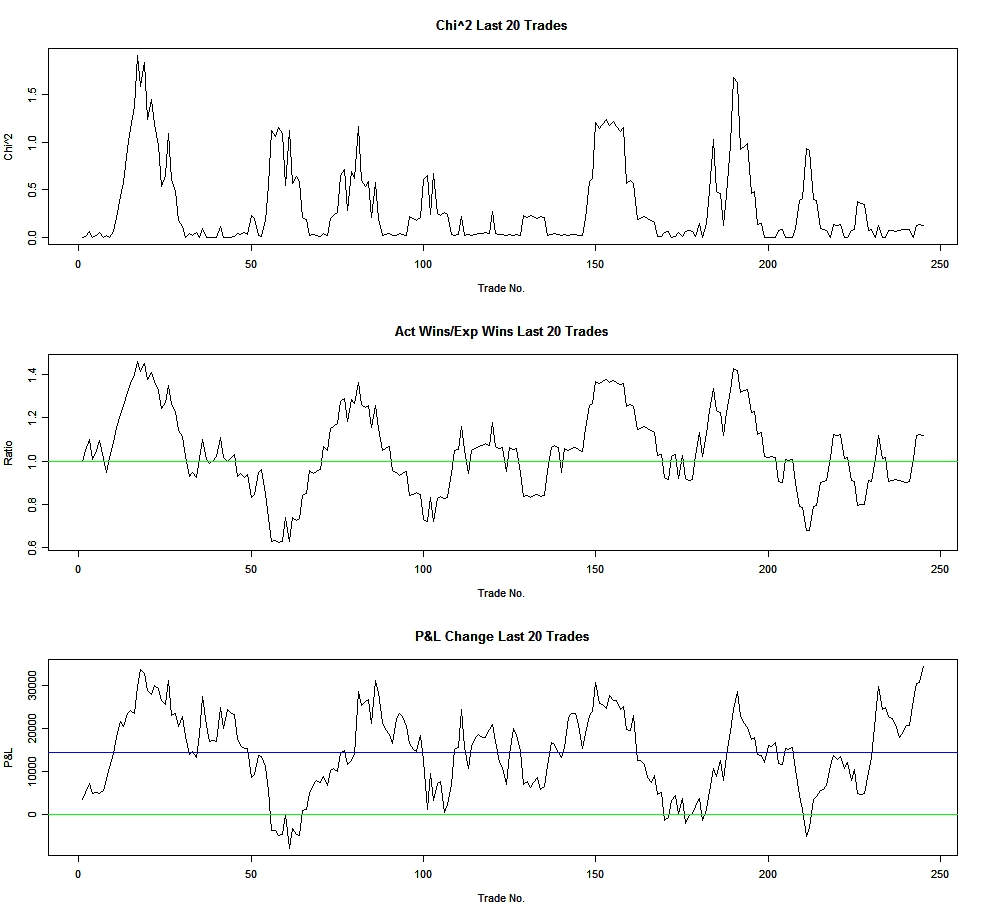

As seen in Control Charts and Forecasting, the following control chart shows some cyclicality, especially the bottom chart of the system's P&L -

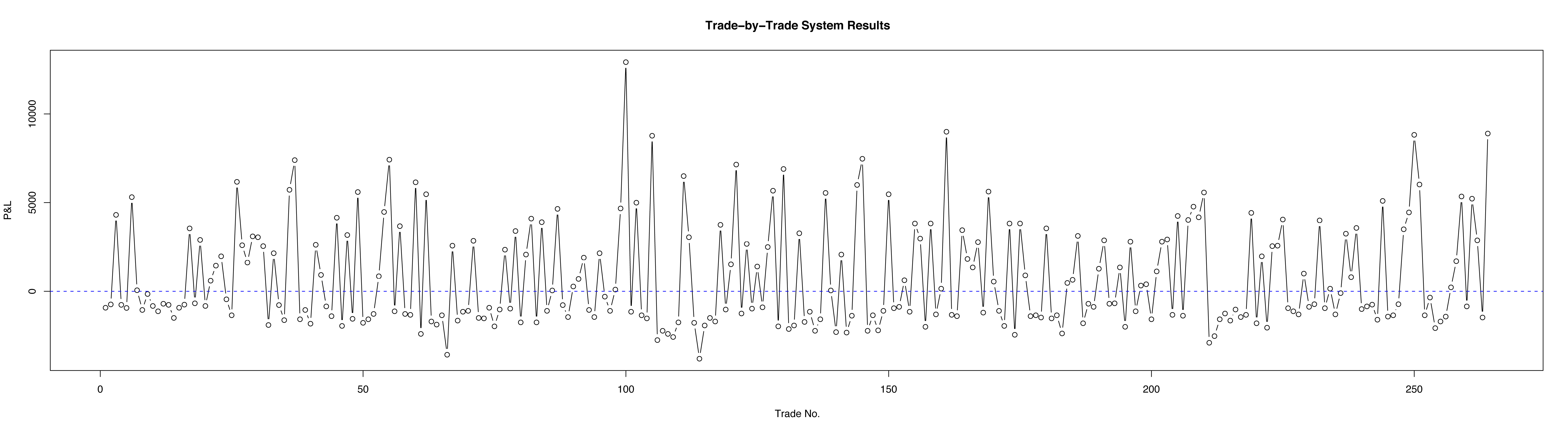

In addition to cyclicality, the following trade-by-trade plot of the same system, seems to show dependency of the next trade result on the prior result, especially after a winning trade -

Using the tests in Ralph Vince's The Handbook of Portfolio Mathematics, I got the following results (as z scores):

Runs test: 0.78These z scores are all insignificant - Z scores greater than 1.6 are the beginnings of significance - and the test results show no dependency of the next trade on the prior trade.

Turning Points test: 0.07

Correlation test: -0.06

To double-check these results, I modified the system to skip the trade following a winning trade, as would seem to be indicated by the trade-by-trade plot above. The system results were little changed, confirming the test results of no dependency of the next trade on the prior trade.

You can download my R script of the Runs, Turning Points and Correlation tests from Vince's book here.

And now to look into the cyclicality...