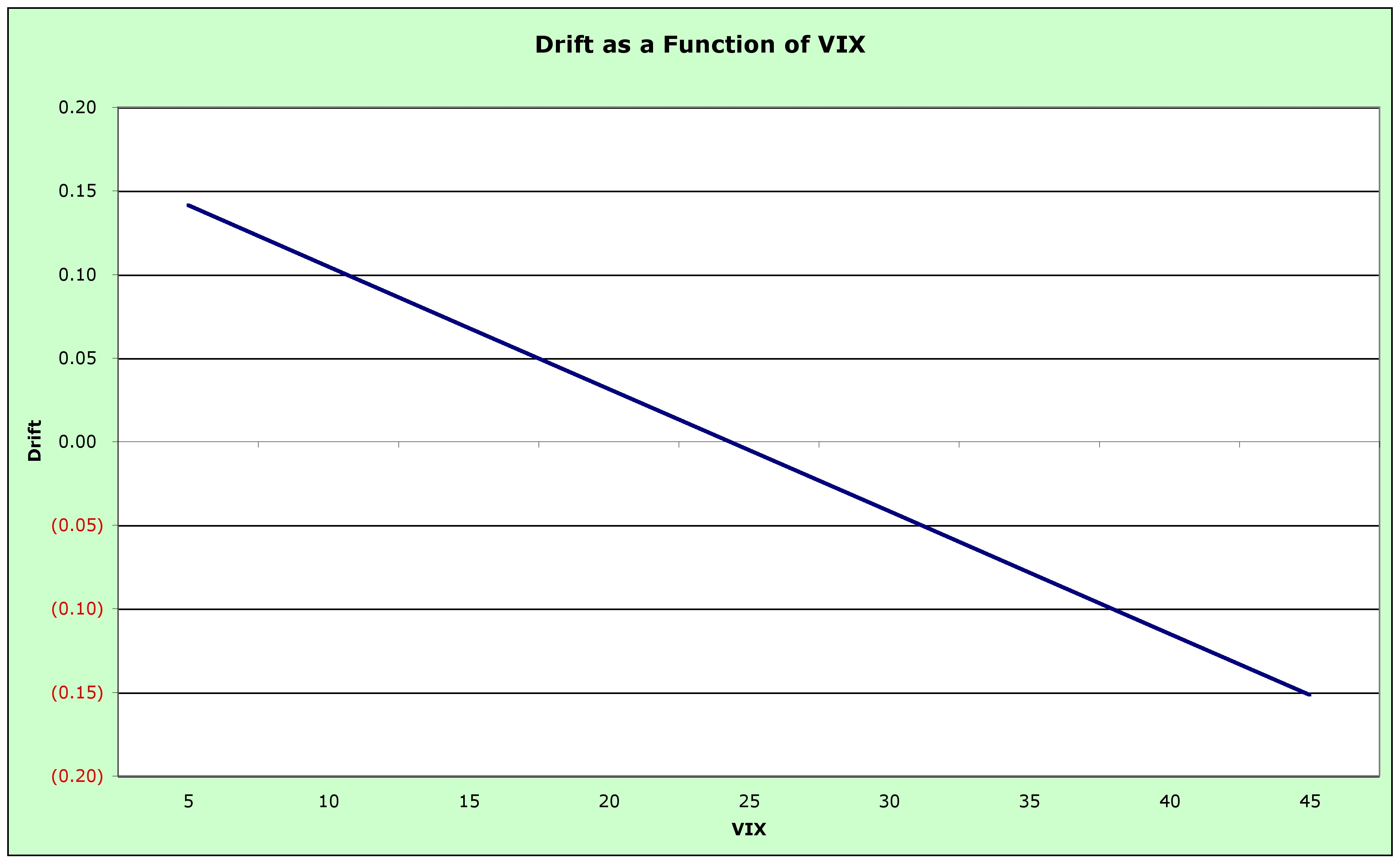

Drift as a Function of VIX, 07/12/0

System designers and discretionary traders can use the relationship between VIX and Drift tobuild more robust systems and make better trades.

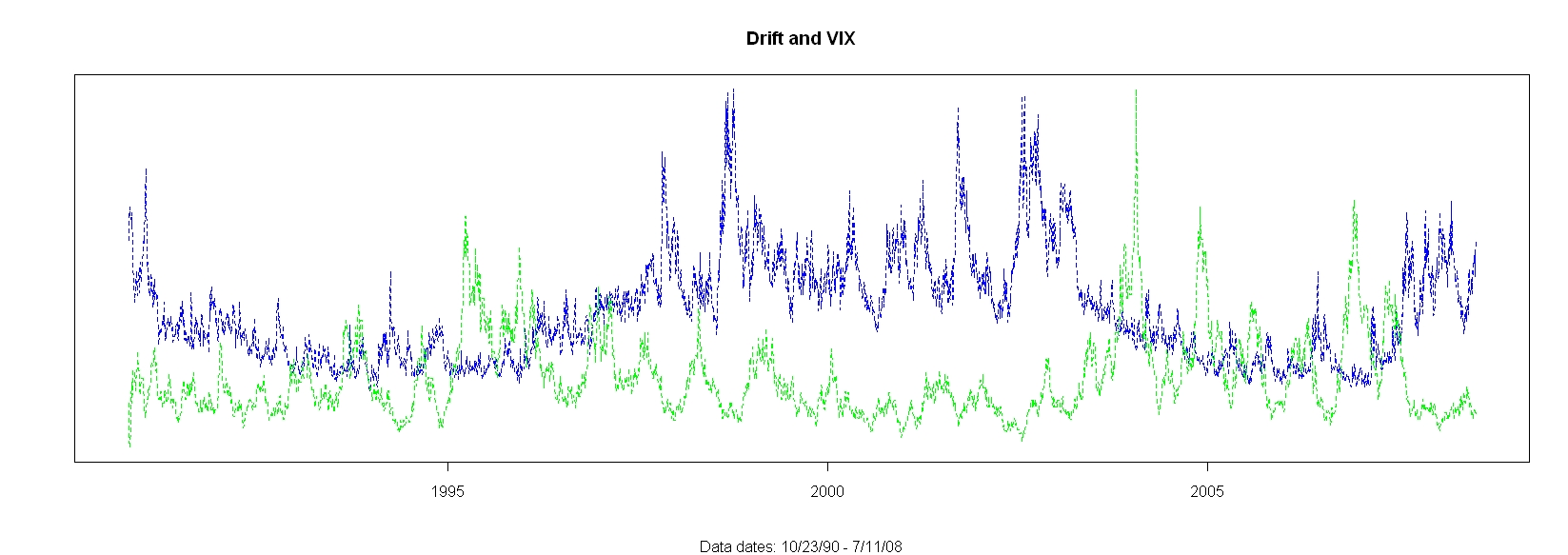

This is a plot of the Drift (green) and VIX (blue) from 1991 thru yesterday where both Drift and VIX have been scaled from 0 to 1 -

The Drift is defined as the tendency of the market, in this case the S&P, to go up. Thinkof Drift as the opposite of gravity - the more Drift there is the more the market goes up, theless Drift and the more the market goes down.

VIX is the CBOE Volatility Index. Think of VIX as uncertainty about the value of the market, thehigher the VIX the more uncertain market participants are about the overall value of the market.

Intuitively, VIX and Drift should be inversely correlated - higher uncertainty (VIX) == higher gravity (lower Drift). And, in fact they are, with an equation of:

Drift = .178 - (VIX * .335)A plot of the relationship between VIX and Drift -